Student Guide: How to Apply for a PTPTN Loan in Malaysia 2025

May 26, 2025

Mehmil

Finances can be a big worry when it comes to getting your education, especially with tuition fees and daily expenses piling up. That’s why many Malaysians students turn to PTPTN loan.

It is the go-to student loan that helps make paying for college or university a whole lot easier. PTPTN offers low-interest loans and flexible repayment plans, so you can focus on your studies without stressing over money.

This simple guide will help you understand how to apply for PTPTN, and get your PTPTN application approved. Let's go through it.

What is PTPTN Loan?

PTPTN (Perbadanan Tabung Pendidikan Tinggi Nasional) is Malaysia’s national higher education fund that provides student loans to help Malaysians finance their studies at local public and private universities. The PTPTN loan supports eligible students pursuing diploma, undergraduate, and postgraduate programs. It offers affordable financing options with low-interest rates and flexible repayment plans.

Applying for a PTPTN loan is a popular choice for Malaysian students seeking financial aid to study in Malaysia.

Who is eligible to apply for PTPTN?

PTPTN eligibility in 2025 includes criteria like age, income, MQA accreditation, and a valid Simpan SSPN account. Want to apply for a PTPTN loan? Before applying, make sure you meet all the following conditions:

- You must be a Malaysian citizen.

- You must be 45 years old or younger.

- You must have an offer letter from a recognised public or private institution or polytechnic.

- Your course must be approved by the Ministry of Higher Education and accredited by MQA.

- You must have at least one semester left in your studies.

- Your parents’ or guardians’ gross monthly income must not exceed RM50,000 (RM250 deducted per dependent).

- You cannot have other sponsorships or scholarships.

- You must have a Simpan SSPN Prime or SSPN Plus account with a 15-digit number

What Courses Are Eligible for PTPTN Loan?

Not all courses qualify for the PTPTN loan. To be eligible, your course must meet these criteria:

Qualifications & Institutions

- Eligible qualifications: Diploma and Degree

- You can study at public or private institutions for Diploma and Degree courses.

- Professional Courses (e.g., ACCA, ICAEW) and Postgraduate Studies (Masters, PhD) are only eligible if taken at public institutions.

- Pre-University courses (A-Level, Australian Matriculation, Canadian Pre-University) are not eligible for PTPTN loans.

- Part-time courses are eligible only for Diploma, Degree, Postgraduate, and Professional Courses at public institutions and selected private universities.

Here is a quick overview of eligible qualfications and instituitions for PTPTN Loan in Malaysia

| Education Level | Private Institutions (IPTS) | Public Institutions (IPTA) |

|---|---|---|

| Pre-University | ❌ Not eligible | ❌ Not eligible |

| Foundation | ✔️ Eligible at certain private universities | ❌ Not eligible |

| Diploma (Full-time & Part-time) | ✔️ Eligible at selected private universities | ✔️ Eligible |

| Degree (Full-time & Part-time) | ✔️ Eligible at selected private universities | ✔️ Eligible |

| Postgraduate (Masters, PhD) | ❌ Not eligible | ✔️ Eligible |

| Professional Courses | ❌ Not eligible | ✔️ Eligible |

See the detailed list below for eligible private institutions for foundation & part-time courses

| Foundation Courses | Part-Time Courses |

|---|---|

| Multimedia University (MMU) | Open University Malaysia (OUM) |

| Universiti Tenaga Nasional (UNITEN) | Wawasan Open University |

| Universiti Teknologi Petronas (UTP) | Asia E University (AeU) |

| Universiti Tun Abdul Razak (UNIRAZAK) | UNITAR International University (UNITAR) |

| UNITAR International University (UNITAR) | Universiti Tun Abdul Razak (UNIRAZAK) |

Course Must Be MQA-Accredited

- The course you choose must be accredited by the Malaysian Qualifications Agency (MQA).

- Check the MQA website to confirm your course's accreditation status, either full or provisional accreditation is required.

How much can you borrow from PTPTN?

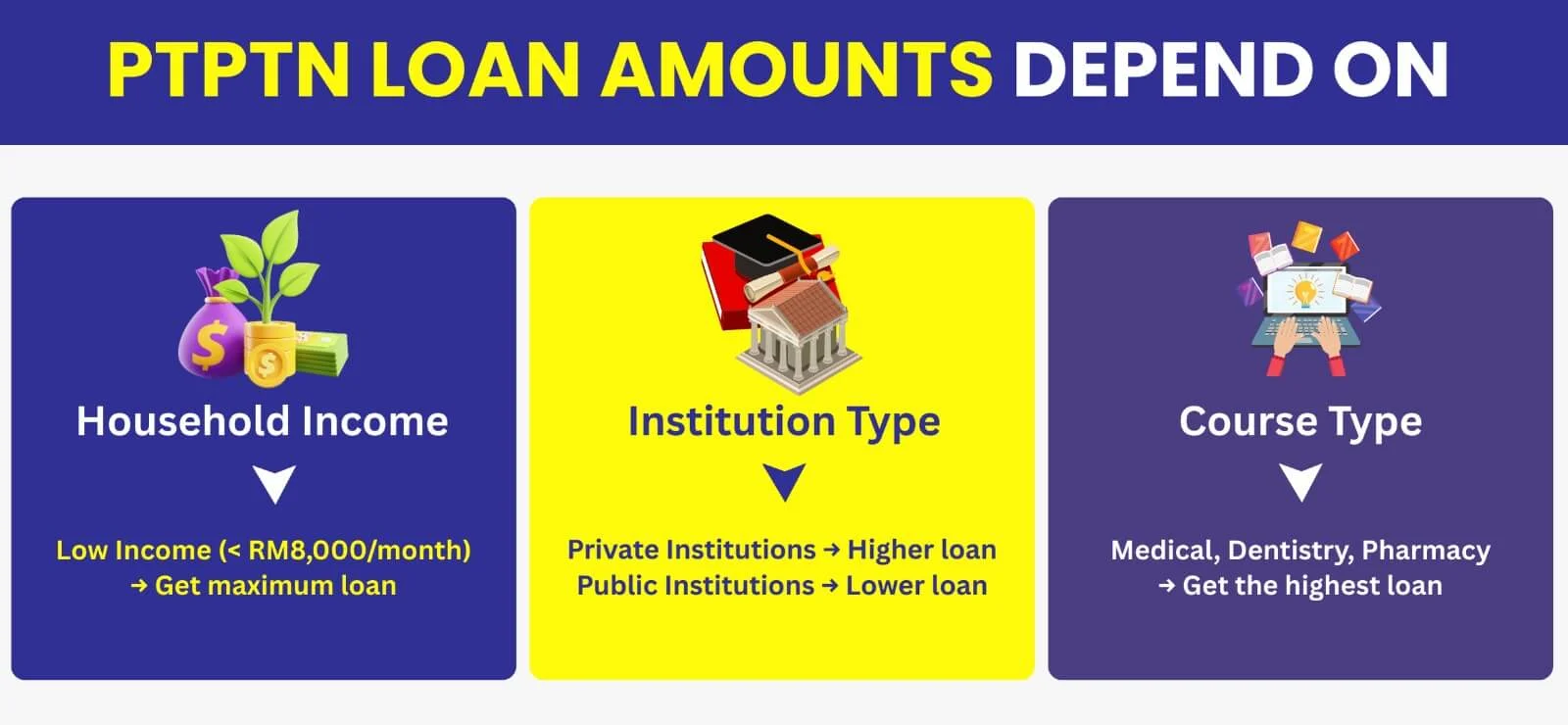

Before we dive into the exact PTPTN loan amounts, it’s important to understand the key factors that determine how much financial aid you can receive.

Your loan eligibility and the maximum amount you can borrow depend on three main aspects:

By Household Income

- STR Recipient / Low Income (< RM8,000/month) → Get maximum loan

- Middle Income → Get moderate loan

- High Income (> RM8,000/month) → Get minimum loan

✅ Simply, you’ll get more support if your family earns less.

By Institution Type

- Private Institutions (IPTS) → Higher loan amounts (tuition fees are higher)

- Public Institutions (IPTA) → Lower loan amounts (tuition is subsidized)

By Course Type

- Medical, Dentistry, Pharmacy → Get the highest loan (up to RM50,000/year for medicine!)

- Science, Engineering → Get a moderate loan

- Humanities & Social Sciences → Slightly lower loan

- Postgraduate (Masters/PhD) → Only funded if you’re in a public university

Now that you understand the key factors affecting your PTPTN loan amount, let’s take a closer look at the specific loan limits based on your institution type and course of study.

Below, you’ll find detailed tables showing the maximum yearly loan amounts for private and public institutions, categorized by household income and course type.

PTPTN Loan Amounts for Private Institutions (IPTS)

| 🎓 Education Level | STR Recipient | Household Income < RM8,000 | Household Income > RM8,000 |

|---|---|---|---|

| Foundation | RM6,800 | RM5,100 | RM3,400 |

| Diploma (Pharmacy, Dentistry, Health Sciences) | RM12,750 | RM9,560 | RM6,380 |

| Diploma (Other) | RM8,000* | RM5,100 | RM3,400 |

| Degree (Medicine) | RM50,000 | RM37,500 | RM30,000 |

| Degree (Pharmacy, Dentistry, Health Sciences) | RM17,000 | RM12,750 | RM8,500 |

| Degree (Science) | RM14,030 | RM10,520 | RM7,010 |

| Degree (Humanities) | RM13,600 | RM10,200 | RM6,800 |

| Postgraduate / Professional | Not applicable | Not applicable | Not applicable |

PTPTN Loan Amounts for Public Institutions (IPTA)

| 🎓 Education Level | STR Recipient | Household Income < RM8,000 | Household Income > RM8,000 |

|---|---|---|---|

| Foundation | Not applicable | Not applicable | Not applicable |

| Diploma / Integration | RM4,750 | RM3,560 | RM2,380 |

| Degree (Humanities) | RM6,180 | RM4,630 | RM3,090 |

| Degree (Science) | RM6,650 | RM4,990 | RM3,330 |

| Postgraduate (Master’s) | RM9,500 | RM7,130 | RM4,750 |

| Postgraduate (PhD) | RM24,700 | RM18,530 | RM12,350 |

| Professional (e.g. ACCA) | RM5,700 | RM4,280 | RM2,850 |

How to Apply for a PTPTN Loan in Malaysia

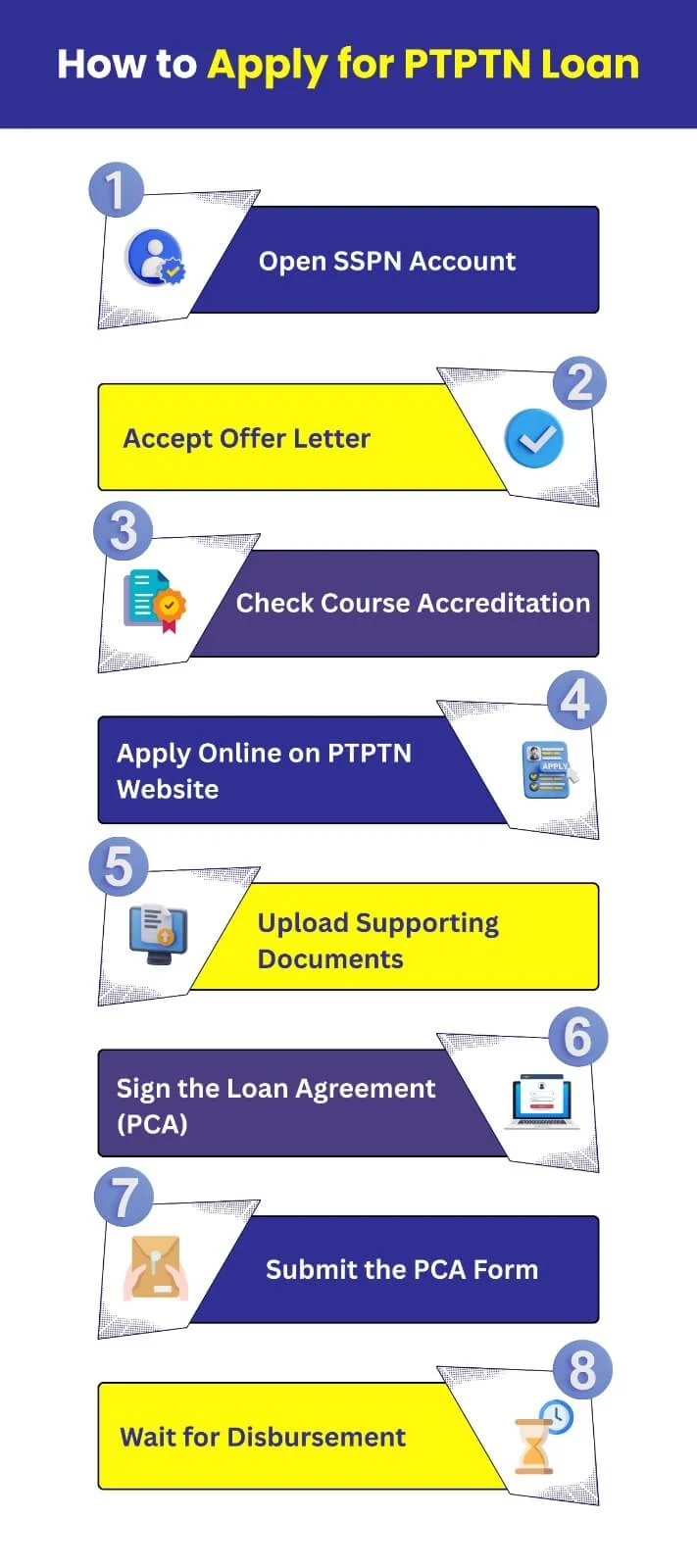

Applying for a PTPTN education loan in Malaysia doesn’t have to be complicated. Whether you’re just starting your studies or already accepted into a university, here are 8 simple steps to follow;

Step 1: Open a Simpan SSPN Prime or SSPN Plus Account

Before applying, you must have a Simpan SSPN account (with a 15-digit number). You can open it online through the SSPN portal or at any PTPTN counter.

Step 2: Accept Your University Offer Letter

Ensure you’ve received and accepted your official offer letter from a PTPTN-recognised university (IPTA, IPTS, or Polytechnic).

Step 3: Check Course Accreditation

Confirm that your course is approved by the Ministry of Higher Education and fully or provisionally accredited by MQA. PTPTN only funds accredited programmes.

Step 4: Register for a PTPTN Loan Application

Visit the official PTPTN website and register for a loan through the Online Application Portal (Permohonan Pinjaman PTPTN). Select your course and university.

Step 5: Prepare & Upload Supporting Documents

Scan and upload all necessary documents, including:

- IC (MyKad)

- Offer letter

- SSPN statement

- Income documents (if required)

Check the full list on the PTPTN portal to avoid delays.

Step 6: Sign the Loan Agreement (PCA)

After approval, print and sign the Loan Agreement Document (PCA). This must be done in black ink, and signed in the presence of a witness (21 years or older, not a family member).

Step 7: Submit Agreement to PTPTN

Submit your signed PCA and required documents at any PTPTN branch or counter. Some universities may also collect them on your behalf.

Step 8: Wait for Disbursement

Once approved, your PTPTN loan will be disbursed directly to your university and your account (if there’s a balance). Track your application and disbursement status through your PTPTN portal.

PTPTN Loan Disbursement: When & How You’ll Receive the Money?

Once your PTPTN loan is approved, the money will be credited directly to your CIMB Bank savings account. Here’s how the disbursement process works:

Disbursement Schedule

- First Disbursement: After you submit all required documents and PTPTN verifies them.

- Subsequent Payments: Disbursed twice a year, once per long semester (short semesters and internships are not funded).

- Expect your first disbursement within 1 to 2 months after the loan agreement submission deadline.

Conditions to Receive Future Payments

- To continue receiving your PTPTN loan, you must:

- Be actively enrolled in the approved programme and institution.

- Achieve a minimum GPA of 2.0 or a PASS grade for that semester.

- Ensure your university confirms your academic status with PTPTN.

When Loan Disbursement Will Be Withheld

PTPTN can suspend your loan payments if:

- You score below GPA 2.0 or fail in the semester.

- You defer or suspend your studies.

- You go on a student exchange programme

PTPTN Loan Insurance (Takaful Coverage)

All PTPTN loan recipients are automatically covered by group Takaful insurance, which is a form of Islamic insurance that protects you and your family in the event of death or total permanent disability.

Here’s what you need to know:

- It’s Mandatory: All students who take the PTPTN loan must be covered under this insurance.

- Handled by PTPTN: You don’t need to choose or contact the insurance provider; PTPTN arranges it for you.

- Automatically Deducted: The insurance premium (called takaful contribution) is deducted from your total approved loan amount, so you won’t have to pay out of pocket.

- 24/7 Worldwide Protection: You're covered wherever you are, at any time.

PTPTN Loan Repayment & Interest Rate

Once you’ve received your PTPTN loan and completed your studies, it's time to pay it back, but don’t worry, the process is straightforward and the cost is lower than most education loans in Malaysia.

When Do You Start Paying Back?

- You’ll need to start repaying your PTPTN 12 months after finishing your studies, whether or not you’ve started working.

- PTPTN won’t send you reminders, so it's your responsibility to start paying on time.

How Much Will You Pay?

PTPTN loans have a flat 1% interest rate (ujrah), a syariah-compliant administrative fee. It’s added to your total loan and repaid over time.

Here’s an estimated monthly PTPTN repayment based on how much you borrow:

| Loan Amount | Repayment Period | Monthly Repayment (incl. 1% interest) |

|---|---|---|

| Less than RM10,000 | 5 years | ~RM175 or less |

| RM10,000 – RM22,000 | 10 years | RM92 – RM202 |

| RM22,000 – RM50,000 | 15 years | RM140 – RM319 |

| More than RM50,000 | 20 years | RM250 – RM750 |

What Happens If You Don’t Pay?

Defaulting on your PTPTN loan can have serious consequences:

- You’ll be blacklisted in CCRIS, affecting your credit score.

- This makes it harder to apply for loans, credit cards, or home financing.

- While the travel ban has been lifted, your financial reputation stays affected until you clear your debt.

- If you’re struggling, PTPTN allows you to restructure your loan. Just visit the nearest PTPTN branch to discuss new terms.

Check out: Your Guide to Paying PTPTN Through Direct Debit Method

Convert Your PTPTN Loan Into a Scholarship!

Did you know? If you graduate with First Class Honours, your PTPTN loan can be fully exempted, meaning you won’t have to pay it back at all! That’s basically a full scholarship for your degree.

What Counts as First Class Honours?

Usually, it means earning a CGPA of 3.67 or higher (out of 4.00), but this can vary between universities. So, make sure to check with your university counsellor about your specific target.

- This exemption applies only to Degree programmes.

- You must complete your degree within the normal study duration stated in your PTPTN loan agreement.

- If you exceed the standard study period, the exemption won’t apply.

Got questions about PTPTN loan exemptions?

Talk to our study advisor and get guidance on your best universities and courses options!

Applying for a PTPTN loan is a great way to fund your higher education in Malaysia, whether at public or private institutions. By understanding the eligibility criteria, application process, and repayment terms, you can make informed decisions and maximize your chances of approval.

Good luck, and we wish you all the best for your PTPTN Loan application!

Frequently Asked Questions

1. Can I apply for PTPTN loan if I study part-time in Malaysia?

Yes, part-time students enrolled in recognized Malaysian institutions can apply for the PTPTN education loan, as long as the course and university meet PTPTN’s eligibility requirements.

2. What happens if my PTPTN loan application is rejected?

If your PTPTN loan application is rejected, you can reapply after fixing the issues that caused the rejection. Always check your application status online and contact PTPTN for detailed feedback.

3. How long does it take to get PTPTN loan approval?

PTPTN loan approval usually takes about 4 to 6 weeks after you submit all the required documents and meet the eligibility criteria for Malaysian student loans.

4. What is the interest rate for PTPTN loan in Malaysia for 2025?

For 2025, PTPTN loans have a flat interest rate of 1% per annum or a syariah-compliant ujrah fee, calculated on the total loan amount throughout your repayment period.

5. What is the maximum PTPTN loan amount in Malaysia?

The maximum PTPTN loan depends on your course and institution type, with medical degrees receiving the highest funding, up to RM50,000 per year for medicine and related health programs.

6. Can I Get PTPTN Loan for a Second Degree?

If you have not taken a PTPTN loan for your first degree, you can apply for a loan for your second degree. However, if you already borrowed PTPTN for your first degree, you must fully repay that loan before applying for a new PTPTN loan for your second degree.

Kickstart your education in Malaysia

We'll help you find and apply for your dream university

You might be interested in...

- Sunway University Educators Share Timeless Career Skills for a Changing World

- Top Private Universities in Malaysia (QS Rankings 2026)

- APU and GUT Launch New Tech College in China: Earn Dual Degrees

- Global Learning at the Crossroads: Canada–Malaysia’s Evolving Education Partnership

- How AI is Powering the Next Wave of MSME Growth in Malaysia

- Malaysian Private Universities Making a Mark in Global Rankings

- Benchmarking Malaysian Private Universities Against Their ASEAN Peers

- Fastest-Rising Malaysian Universities in the QS Rankings (2023‑2025)

- Sunway University Climbs to Global Top 500 in QS Rankings 2026

- Trusted by Top Universities: EasyUni’s Exclusive Visit to Sunway University

+60173309581

+60173309581