7 Additional Information about PTPTN You Might Need to Know

April 01, 2022

EasyUni Staff

1. The amount of loan

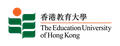

A comparison of past and current PTPTN policies.

As reported by The Sun Daily, the number of applicants receiving full PTPTN loan is predicted to decrease by 43% (from 180,000 to 102,000) due to the policy revision that has been implemented since 1 November 2014.

Before the revision, students with household income of less than RM4,000 per month will be given a full loan.

From now on, only students whose parents are BR1M (1Malaysia People’s Aid) recipients will be considered for full loans.

Nevertheless, the number of students who are eligible for 75% loan is expected to increase. This is because the new policy allows students from non-BR1M families with monthly household income of less than RM8,000 to receive a loan up to 75% of the maximum amount.

Prior to the revision, 75% of financing is only available for students with monthly household income between RM4,000 - RM5,000 while those with monthly household income more than RM5,000 will only be given 50% of the amount.

2. The conversion of loan into scholarship

There is a repayment exemption for bachelor's degree students who graduate with first-class honours. In this case, the loan will be converted to scholarship and no more further repayment has to be done.

Besides achieving first-class honours, there are other criteria you need to take note of in order to be exempted. You must also check with your university/college first, as different institutions have different rating for first-class honours.

3. The termination of financing

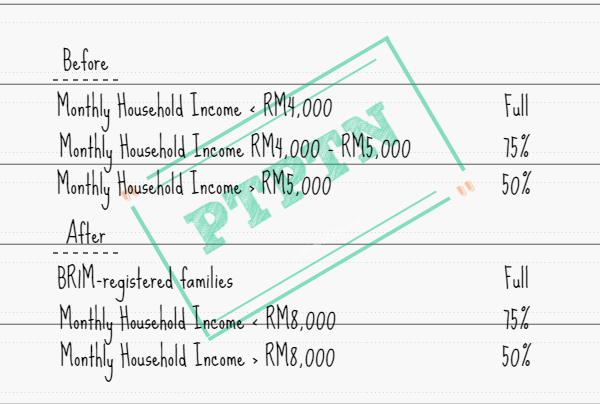

Circumstances that might cause PTPTN loan to be suspended/terminated.

As stated on the PTPTN official website, the disbursement of PTPTN loan will be terminated under these circumstances:

(i) failure or the termination of study in the approved course/IPT

(ii) students receiving other sponsorships

(iii) falsification of information during the application

(iv) students declaring bankruptcy

(v) students terminating the loan themselves

The disbursement will also be suspended if applicants fail to obtain a GPA of 2.0 and above. The same goes to those who defer their study / suspended by their university/college.

4. Insurance

The amount of loan students receive may not be equal to the amount it should be due to the Student's Insurance Policy. Starting from 1 June 2008, all PTPTN applicants must register for the Student’s Insurance Policy and the insurance will then be deducted from the loan. The deduction is automatically done every time the loan is released to recipients.

5. WPP (Wang Pembiayaan Pendahuluan)

WPP is for students who need money urgently for IPTA registration purposes.

There is a surprising number of students who have never heard of WPP.

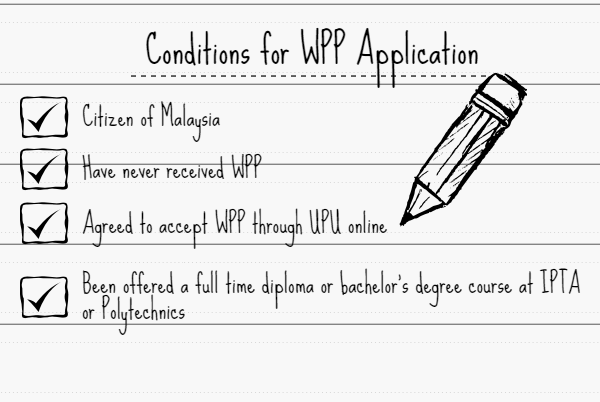

WPP (RM1,500) offered to applicants who need money urgently for their registration at IPTA and Polytechnics. To be eligible, one must meet the criteria stated on the PTPTN official website.

For those whose PTPTN application has later been approved, the amount of money obtained from WPP will be deducted RM500 per semester from the total financing disbursement until it is all paid off.

For non-PTPTN applicants, you have to make your full repayment within the nine months from the date of warrants. You may also check out these links: http://www.ptptn.gov.my/web/english/wang-pendahuluan-pembiayaan-wpp (for repayment method), http://www.ptptn.gov.my/web/english/loans/advanced (for WPP introduction).

6. Repayment of the loan

All PTPTN recipients are responsible to repay their loan after 6 months of completing their studies. In order to make the repayment convenient, the government has rolled out different payment platforms: recipients can choose to repay the money through over-the-counter payment, online banking, direct debit services and even salary deduction. For more information about the repayment channels, you can refer to this link: http://www.ptptn.gov.my/web/english/repayment-channels.

7. Closing date

Please be reminded that only the application completed before the closing date is accepted. The closing dates for different IPTA and IPTS are all stated on the PTPTN official website. Always stay updated about the closing dates of the application.

Considering that students may need professional assistance on the PTPTN application, the government has set up offices and kiosks all over the country where PTPTN staff can provide immediate and accurate response to the students through face-to-face discussion. The locations and the operation hours of the offices and kiosks can all be found on the website.

Here’s a guide on how to apply for PTPTN: https://www.easyuni.my/advice/ptptn-application-is-never-that-complicated-1221/

Kickstart your education in Malaysia

We'll help you find and apply for your dream university

You might be interested in...

- Promoting Health and Well-being: Initiatives by Universities in Malaysia

- Raising Awareness of the Threat of Microplastics Pollution on International Mother Earth Day

- Exploring Distance Learning: Course Offerings at Universities in Malaysia

- The Role of Education in Promoting Health Equity: Lessons from World Health Day 2024

- Navigating Credit Transfers: A Guide for Students Switching Institutions

- Explore the Benefits of Studying in Malaysia After SPM Examination

- SPM Leavers’ Guide to Malaysian Scholarships: Types, General Requirements, and Practical Tips

- Crafting a Greener Tomorrow: Empowering Change through Zero Waste and Upcycling Practices

- Malaysian Higher Education's Global Outreach: Collaborations with International Institutions

- Initiatives by Universities in Malaysia to Prepare Students for Globalization